When I started looking into using an IUL (index universal life insurance) as an asset to grow and protect my money, I had a ton of questions.

I did a lot of research and found a lot of conflicting information. There are all kinds of pitfalls to building an IUL correctly. If it’s done wrong, you can really end up wasting your money. Unfortunately there are a lot of salespeople and marketers of the IUL who don’t tell the whole story and this can give this product a bad name. What gets me excited about this is when properly structured, properly sold, and properly used, I have found the IUL to be one of the best financial vehicles in the world.

I did a lot of research and found a lot of conflicting information. There are all kinds of pitfalls to building an IUL correctly. If it’s done wrong, you can really end up wasting your money. Unfortunately there are a lot of salespeople and marketers of the IUL who don’t tell the whole story and this can give this product a bad name. What gets me excited about this is when properly structured, properly sold, and properly used, I have found the IUL to be one of the best financial vehicles in the world.

I’m writing this to help people know what questions they should be asking. What do you need to know before buying an IUL? How do you find a person competent to build it for you?

Lets jump in…

1. How Much Are The Fees?

We always want to minimize fees whatever we do. Unfortunately every financial vehicle has fees, whether it’s rental real estate with the taxes, closing costs, and commissions; 401(k)’s often have multiple different fees; or mutual funds that charge fees for buying and selling funds within the fund.

What I found was fees in the IUL are driven by two factors. First is the company you use, and second is the structure of the policy.

You want to find a company who is an IUL specialist. These companies buy options in volume and know how to price the product properly. There are a couple of different life insurance companies to be aware of, mutual and stock insurance companies.

The definition of a mutual life insurance company is the policy holders are the owners. Whereas the definition with a stock insurance company is the stockholder’s have a stake in the ownership. You can choose which insurance company best suits you.

When you structure these policies for the lowest cost structure you buy the lowest death benefit allowed, and the death benefit is what drives the fees.

The higher the death benefit, the more commission the agent earns, and the higher the insurance and internal policy costs.

When structured for lower death benefit, the fees usually decrease and the total fees for the policy can end up costing 1-1.5% averaged over the life of the policy…but here’s the kicker, there are two important things to consider when it comes to fees in these policies.

First, unlike 401(k)s, mutual fund fees, taxes and real estate commissions, in an IUL you are actually getting a product for your money. Your family or estate actually gets a death benefit paid to them when you die. What other financial tool can say that?

Second, if you get a policy with an index crediting bonus after year 10, this can effectively help cover your insurance costs after that point throughout your life…(so you want a policy with that kind of cash value bonus).

Third, unlike money management fees, where the more you make, the more you pay, you aren’t paying a percentage of your cash value in fees…so you aren’t penalized by having your nest egg grow.

One of the downsides of these policies is that in the first several years the fees are high. It’s kind of like a mortgage, where in, the first few years are much more expensive than the rest. The high cost of paying 90% of your first 5 years to interest on a mortgage doesn’t stop people from buying homes, does it? They know it’s a temporary cost for a long-term benefit. The same goes here.

The word ‘fee’ usually refers to paying something for nothing. Some people feel that is basically what they are doing with their managed money investments. You pay a fee every month and no matter if your money goes up or down, you are still getting charged fees. What do you get in return? Hopefully they are getting advice from the advisor for the product they bought.

With life insurance the costs are actually buying you a product. A tax free death benefit…and if you get the right policy you can use the death benefit while you are still alive in the form of critical or chronic illness and when you die you get your death benefit paid to your heirs tax free.

2. Huge Commissions

What I’m going to share with you here is going to make a lot of people in the insurance industry mad. They don’t want me sharing this with consumers. But I’m more interested in educating you about the truth and you need to know this.

Here’s how commissions work: the insurance company pays a one-time commission when a policy gets purchased. The big complaint you will see online is that agents make big commission. For the most part that’s true, if you buy a policy from your average agent and they don’t build this correctly, then the commissions are big, the fees are big, and the cash value is small.

We recommend you use a Death Benefit Optimizer (DBO) strategy that can reduce the commission by as much as 70%.

As you can understand, many agents don’t like using the Death Benefit Optimizer because they are in it for the commission. However, you want this to be a great financial tool and the more of your money going to commission the less there is in the policy to grow.

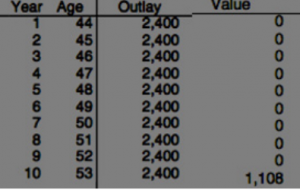

Let me give you an example of a 44-year-old woman putting in $2400 per year. One option for the policy WITHOUT the death benefit optimizer is to start with a $496,000 death benefit. This would pay the agent $6,605.19 in commission.

Let me give you an example of a 44-year-old woman putting in $2400 per year. One option for the policy WITHOUT the death benefit optimizer is to start with a $496,000 death benefit. This would pay the agent $6,605.19 in commission.

Now I don’t have a problem with an agent, or anyone, getting paid for the work they do. (And keep in mind the agent is getting paid one time. They usually don’t get paid a commission ever again and they are going to service your policy for the rest of their lives, so they need to get paid. However, there is a much better way.)

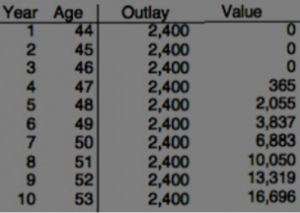

In this example, the exact same person is using a policy with the Death Benefit Optimizer. The death benefit amount starts at $208,000 (less than half) and the commission is down to $2,883… less than half.

In this example, the exact same person is using a policy with the Death Benefit Optimizer. The death benefit amount starts at $208,000 (less than half) and the commission is down to $2,883… less than half.

You can see the difference in cash value by year ten. Using the DBO the client has close to $17,000 vs. $1,108 in their cash value account! It’s no wonder why people have such terrible things to say about these policies! Unscrupulous and unethical agents are out there padding their commissions at your expense.

Using the wrong agent to build this for you can be a terrible mistake. Can you see why agents hate us sharing this stuff with you?

If you do it right, you can reduce commissions and fees by as much as 50% to 70%, and the rest of your money goes to cash value.

3. What happens if the market goes down multiple years in a row?

If the market goes down 10 years in a row there are risks to the policy. Your cash values will not go down because of the market, but they can go down because of insurance costs in the policy.

This is another reason why it is CRITICAL to get a policy with the lowest insurance and internal costs possible.

The likelihood of that happening is low; however, it could happen. What would happen to your 401(k) and IRA if the market goes down 10 years in a row?

If you truly believe that the future of the country is in complete ruin, then you may want to put your money toward food storage instead.

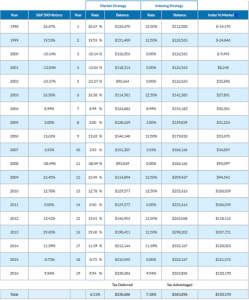

What if the market goes down 3 years in row? History is a great teacher, so I went out and researched what the S&P 500 had actually done for the past 18 years, since 1998. In 2000, 2001, and 2002 the S&P 500 had 3 down years in a row, and then another drop of nearly 40% in 2008. In the example below, using a cap of 12.5% and floor of 0% still outperformed the S&P 500, 8.9% compared to 8%…but more importantly, notice how much extra money is in the cash value account.

We can’t spend percentages. In fact, percentages are misleading. If you lost 50% one year, and gained 100% the next year you would ‘average’ 25% return and still have no more cash in your account.

We can only spend cash.

So, in this scenario, you’d have $133,000 using a cap and floor strategy than the S&P 500 strategy… that’s what really sold me on the value of not losing money during market crashes.

4. Are these projections realistic?

It’s easy to put numbers on paper and project how much money you might have 20 or 30 years into the future.

But I wanted to know are these ‘illustrations’ or projections actually accurate?

Because of unscrupulous agents selling unrealistic projections, recently the industry has created guidelines that don’t allow agents to show projections higher than a set percentage that is realistic and that you are likely to achieve.

For example, I know of agents who used to illustrate 8.5% or 9%.This is crazy in my opinion.

So when you hear people say it’s unrealistic, now you know why.

Fortunately now the practice of agents projecting huge returns because it’s easier to sell is all but gone. I’m happy to see it happen.

5. What happens if I lose my job?

Buying one of these policies is a bit of a long-term commitment. And the future is never certain, so another one of my concerns was, “What happens if I lose my job, or can’t pay the premiums?”

What I found is a benefit of the IUL is that these premium payments in IUL policies are flexible. You aren’t locked in to one payment.

That means if you need to reduce your payment down to the minimum to just keep the policy in force, you can do that. Usually is about 20% of your normal monthly premium. Then in subsequent years, you can catch up by putting more money back into the policy if you want to.

This is what people usually do if for some reason money gets tight.

Another option is using cash value to pay premiums. This is obviously only available if you have enough cash value in your policy to work with. If you do, then you can actually stop paying premiums entirely and use the cash value to pay the premiums for a period of time until you get back on your feet. It’s important to pay back what was borrowed so you can maximize your ability to borrow in the future.

This is not recommended, but it is possible. At retirement the idea is that your cash value could be putting off enough growth to pay fees and sustain the policy for as long as you live. But not paying premiums for an extended period of time during your working years could cause the policy to cancel, which we definitely want to avoid.

6. Buying virtually

At first I was a little nervous buying from someone I’d never met before. What I realized was that whether I buy from someone over the phone, or face-to-face, I’m still doing business with an insurance company that has been in business for over 100 years. I have bought car insurance over the phone and Internet, and I have also done other large financial transactions like a home mortgage, and refinancing. This is really not much different.

The insurance company is there; their physical buildings, offices and employees are there when you need them.

Premiums get paid to carrier; they are the ones backing your policy, so whether you meet your agent or not, they will still be the ones guaranteeing your policy…and you’ll probably never meet them face to face either.

Please be sure to thoroughly vet whatever company and agent you choose to work with, and always send money directly to the insurance company to pay premiums.

7. What are the guarantees?

I wanted to know what the worst-case scenario was for these policies. What is actually guaranteed?

We all know very little in life is guaranteed, but in this case there are several guarantees built into the policy. First is a guarantee that your cash values will not go down due to a market loss. Second, you can use the fixed account for your cash value that will guarantee your growth at a specific percentage every year, regardless of what the index does.

The third guarantee is, in my opinion, almost worthless…it’s a small floor, usually about 2%. This guarantee states if your policy hasn’t averaged 2% for the life of the policy at the time you die, or surrender the policy, the company will credit your cash value so you would have at least averaged 2% compounded.

The reason why this is nearly worthless, in my opinion, is that by the time you die or the policy surrenders, it’s too late.

It’s highly likely that the policy will far outperform this guarantee anyway, so it’s not really too much to get excited about.

I wouldn’t buy this product based on that guarantee…and if an agent is really selling you on this, you might want to reconsider who you are doing business with…because it’s more than likely not a real useful benefit.

There is a way to get guaranteed growth each year regardless of what the market does. You can put some of your money, 15% of your premium, into the guaranteed fixed account. If you do this, you will know that even in years when the market goes down, your cash value will be growing. The negative to that is in the years the market goes higher, the money in that account will still only get the fixed guaranteed growth.

Another guarantee to look for is a guaranteed participating loan so your loan interest rate can’t go over a certain amount. Some companies offer an index loan, which is contractually set within the policy and the interest rate on the loan can never increase.

8. Why haven’t I heard about this before?

This is a question I asked initially…and almost everyone who is looking into an IUL asks as well…

“Why haven’t I heard of this before?”

The answer I found was in looking at the financial advertising we see on TV, radio, magazines, online, etc.

It’s companies like big banks, Wall Street brokerages, mutual fund companies, and more who are all part of the Wall Street machine…

What incentive do they and their brokers have to teach you about these policies? ZERO. A dollar put into an insurance policy is often a dollar out of their pocket.

Another reason you may not have heard about it is because of the extremely tight restrictions regulators have put on the advertising of these products. You can’t use words like retirement plan, safe, secure, tax free, etc. So advertising for them is limited.

And lastly, the other reason so few people know about these policies…they are relatively new! This is a new and improved product that was only innovated in the past 15-20 years. But it’s backed by companies using strategies that are 100 years old. Now over 1.5 billion dollars per year are going into these assets, because people are becoming more and more aware of it. (SOURCE: Winks Sales and Market Report 2nd Quarter 2015.)

9. Why is there negative stuff online about this?

I found quite a bit of negative commentary online about life insurance. It’s not a surprise, you can find negative reviews on just about anything you are looking for whether it’s pencils or pickup trucks.

I found there are several reasons for this negative stuff online:

First, A lot of the negative commentary comes from — somewhat surprisingly –insurance agents.

These agents are often Whole Life insurance salesmen and make commissions. They have a long list of reasons why the IUL is not good…what they don’t tell you is that most, if not all, of those concerns are overcome by structuring the policy properly. (Many of the same negative arguments can be made about their own products…but of course they don’t tell you that.)

These whole life or term life insurance agents lose sales to other competitors and so they are the source of much of the negativity out there.

Second, many agents have promoted policies promising unrealistic interest credits… they show illustrations of between 8% to 10% for 40 years in a row…We already covered this. It looks very exciting on paper, but reality may be a totally different story. When you structure these policies correctly and understand the benefits, these policies don’t need hype or unrealistic promises. That’s why you want to look at illustrations with interest credits between 6-7%…this way you can plan for growth that you are likely to get over the long haul…

Third, often you’ll find people criticizing the ‘huge commissions’ that are made on the sale of these policies. The truth is the commission in the first year can be largely dependent on how big the policy is: however, keep in mind the life insurance agent will be servicing his or her client for years down the road with very little to no compensation at all. The good news is, you aren’t paying a percentage of your portfolio to a money manager year after year after year, even when the market goes down. When the policy is structured properly you can reduce these commissions by 50-70%.

Fourth, Dave Ramsey and Suze Orman hate permanent insurance. They actually are correct when they say that these policies are too expensive and give low rates of return… if you aren’t careful and if you buy a run of the mill permanent insurance policy, which is not a properly structured IUL.

They are also right if you buy from a company that doesn’t offer the right features, and if you use an insurance agent who builds the policy incorrectly.

Those factors can result in losing some of your tax benefits and the growth of your money.

I’ve worked with several insurance agents, and in my experience the vast majority either do not know how to do this correctly, or they are unwilling to do it. Plus, most agents don’t have access to the few companies that offer the features we need for maximum wealth accumulation…

The insurance agent down the street, or your current insurance agent, may not be educated to build you an IUL the way you need to, in order to maximize your cash value – no matter how nice they might be.

10. Is it too good to be true? How Does It Work? How do I get 7-8% average if my money isn’t in the market?

This is always an interesting question because at first it may seem too good to be true. When you understand the mechanism behind how the policy works it becomes clear that it’s not some mysterious voodoo.

The insurance company never invests your money directly in the stock market. They buy bonds to form the base of their growth, about 5%. They make up the spread between the 5% and the cap, say it’s 12.5%, with options in the index, say the S&P 500.

If the S&P 500 goes up, they exercise the options and credit your policy. If the index doesn’t go up, the option expires.

So just for example sake, let’s say you pay $100 in premium, and they take $5 to buy options. This comes out of your premium in the form of a fee. If the S&P 500 goes up 16% that year, they exercise the option and credit your cash value the 12.5%.

The costs for the options are already built into the policy so it doesn’t cost you ‘extra’ when this happens.

Contrary to what most people think, in most cases, these companies are not making the spread between the cap and what the market does. They are buying the option from an investment bank to fulfill their obligation to credit your policy up to the cap. The amount above the cap the investment bank keeps.

11. What are the risks of these policies?

As I researched this there were 3 major risks I could see with these policies.

The first is the cap. What happens if caps go down? How do you mitigate this risk? The answer is two fold. First, you want a company who doesn’t have a history of lowering caps on existing policy holders and leaving caps high for first time buyers.

This is called ‘buying business’. They leave caps high for new clients and then lower them on existing clients after you are in the door. Some companies play games like this and others do not.

You only want to use companies who rarely, if ever, have lowered caps. And, if they do lower caps, they lower them for everyone equally. This eliminates this behavior of ‘buying business,’ and penalizing existing policy holders.

The other part of the answer is that caps are interest rate driven. The lower the interest rate, the lower caps will be. This is because the underlying investment insurance companies use is bonds, and the less they make on their bonds, the less they can offer to policyholders.

They make up the spread between the bond and the cap using options as we’ve already discussed. Even though we’ve been in a historically low interest rate environment for the past decade, the companies who specialize in IUL have still kept caps in the 12-15% range. This can give you a barometer of where caps will be at the low end of the spectrum.

As interest rates rise, the caps will rise as well, and this means your policy can perform even better. It also means that it’s unlikely that caps will ever go much lower than they are today.

The second risk is the risk of rising interest rates. When you are taking cash flow out in retirement using a participating loan, this typically is offered by insurance companies using a variable interest rate.

Once you have loans borrowed against the policy, what happens if interest rates go up? Well, you need to make sure you get a policy with several protections.

First, you need to get a policy where you can switch between variable and fixed loans throughout the life of your policy, so if rates go too high you can get some relief.

However, the biggest protection here is getting a policy that has a limit or guarantee on the interest rate so it can never go higher than a certain amount. That effectively wipes out any concern over interest rates going too high. As I mentioned before, some carriers offer an index loan where the loan interest rate is contractually set with in the life of the policy and cannot go up.

The third risk in these policies are insurance costs. IUL’s are written with annually renewable term, so each year the insurance costs can go up. There are two ways to combat this:

First, you want to start with a company with a low fee structure. Earlier we discussed the basic difference between a mutual and a stock insurance company. There are some who have a bias towards using one over the other. There are good stock companies and there are good mutual companies and they are all trying to make a profit. The bottom line is you want to work with a carrier who has a history of low fee structures as a place to start. Then decide if you feel a mutual or a stock company best meets your financial needs.

Second, and the most important, is by structuring the policy in such a way that you are minimizing the death benefit, and maximizing the funding for the cash value side of the policy, and using what I call the Death Benefit Optimizer.

This way you are only paying the bare minimum for insurance costs, and keeping those costs down as low as possible.

12. Who is my Agent and how much experience do they have?

What I have found is there are two important characteristics for getting a good agent. First, you want someone who has a lot of experience working with cash value maximization IUL policies.

They shouldn’t just be someone who says, “Oh, I can do that for you.” If they didn’t bring you the idea, they may have little training on it and they may not have access to the right companies.

Second, the training they get is paramount. Many agents have been in the business for 20, 30, even 40 years, but they have no formal training on how to build these policies correctly. A way for you to know if an agent is trained is by asking a few questions. For example, you may want to ask how they typically design a policy, what allocations they prefer, how they design the death benefit option, how do they minimize the fees. The answers to these questions may provide you with insight if the agent you are talking to is trained. If the agent gives vague answers then perhaps that agent is not trained. If the agent response with “typically I minimize the death benefit” and I use a death benefit optimizer, along with other answers based on the information in this article, then you can feel confident that you are talking with an agent who understands how to structure an IUL for your best advantage.

Lastly, you need to be confident in the financials of the insurance company you are buying from, because they are who is backing your policy. If you aren’t comfortable with the insurance carrier, you really shouldn’t move forward.

13. What if tax laws change?

We all know tax laws can and do change, especially when politicians want more money to spend.

As I researched this I found the IRS has changed tax laws twice on life insurance policies, once in 1984, and once in 1988. These two changes were made to stop people from abusing the life insurance policy as a tax shelter.

There have been no tax law changes to these policies in almost 30 years. The life insurance industry has a very powerful lobby, so changes don’t happen regularly to these policies.

The important thing is, in both of these instances, existing policies were ‘grandfathered in’ so they got to keep their extremely favorable policies with no changes.

It’s just another reason to get a policy sooner than later.

14. What if the insurance company goes bankrupt?

This is big. The insurance company you use has to be financially sound.

Fortunately, that is where the insurance industry shines. Rarely, in the 300-year-old history of life insurance, has anyone ever lost money because of a company going bankrupt.

There are two protections on these policies. First is the State Guarantee Association. This basically insures your death benefit and cash values in your policy up to a limit.

The second protection is the industry itself. Whenever a life insurance company is having financial problems, often other insurance companies will step in and purchase it so they keep the reputation of the life insurance strong.

Whenever an insurance company is purchased, the policies are all kept exactly as they are, and the contract remains in force along with all your cash values as well.

The best protection is to buy from an insurance company that specializes in IUL and has great financial strength and a long 100+ year track record.

15. Why use the S&P 500 index?

The S&P index represents some of the strongest and best companies in America.

The returns are fairly predictable and it has performed well over the long term.

Most companies offer multiple options for the index you choose for your policy; however, the S&P 500 is the most common because it gives consistently good returns.

16. What’s better: IUL or whole life?

When I researched this I found it interesting how many agents will go online and disparage each other over this issue.

Agents who promote one over the other are missing the entire point and may be only looking to make a sale.

The answer is simple. The answer is found by determining your goals and your risk tolerance. What do you want to use your policy for, and what guarantees do you want?

The Whole Life product is best for Financing Yourself To Wealth and if you are looking for more guaranteed growth and predictable cash flow.

You can pay in large lump sums of money, that can be borrowed against almost immediately for other investments, and can provide some cash out in retirement, but typically not what the IUL can provide.

Whole life also has the most guarantees. You get a guaranteed growth rate, usually around 4.5% and guaranteed insurance costs (which can be higher than IUL but it’s hard to know for sure, because whole life companies don’t break out the costs for you to see).

Typically you want a dividend paying Whole Life Policy that can boost your returns even higher… however, be warned! Dividends are NEVER guaranteed, even though whole life agents will often lead you to believe they are by telling you they’ve been paid for 100 years or more. The problem with this is that the insurance company can pay a tiny dividend which doesn’t do much for your policy and still keep their record of paying dividends unbroken because it sounds good.

The IUL is usually best for long-term after-tax retirement cash flow.

It can be paid with monthly contributions or large lump sums if you are working with someone who knows what they are doing.

It can provide cash value for Financing Yourself to Wealth after a couple of years, but typically your cash value isn’t available until year 3 or 4.

Insurance costs are not guaranteed, neither is the growth in the policy. However the cash value growth traditionally has been higher than a whole life policy.

I like them both. I personally own both types of policies. I own more IUL policies than Whole Life because my goal is to build a source of tax preferred retirement cash flow that will last me the rest of my life. And the IUL, when constructed properly, is the best tool I’ve found to do that.