If you listen to the gurus on TV and Wall street ‘experts’ you’ll hear a lot about maxing out your 401(k) and IRA contributions in order to get a tax deduction and grow your money tax deferred.

Knowing taxes are likely to be higher in the future, why would you trade in a lower tax rate today for a future rate that could be much higher when you need the money most? Even if taxes don’t go up, deferring taxes to the future can cost you 3 to 5 times more at withdrawal than you save by getting a tax deduction your working years.

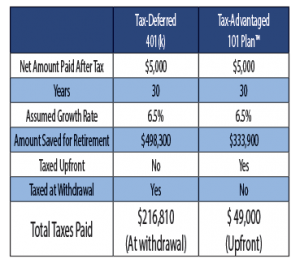

Don’t take my word for it, just look at the math. Here we’ll compare paying tax today and creating tax free retirement cash to deferring taxes to the future:

In this example, let’s say you contribute $5000 per year for 30 years. With a 401(k) you paid no taxes on that money because you got a deduction, on the other side, you would have paid tax at your normal income tax rate, let’s assume 33%.

With the Tax-Advantaged 101 Plan™ life insurance policy you would pay $49,500 in taxes ($1650 per year x 30 years).

In this example, when you retire you’ll have $498,300 in the tax-deferred plan or $333,900 in the tax-advantaged 101 Plan™ life insurance policy.

You’re probably thinking this is a no brainer—I’ll take the tax-deferred plan with the bigger balance. But there is a catch. Let’s say you take out $73,000 a year to live on during retirement. Assuming your money is still growing at 6.5%, you can take $73,000 a year for nine years. However, each year you will have to pay $24,090 in taxes on that money.

That means you could end up paying $216,810 in taxes vs. $49,000 with the tax advantaged 101 Plan™ life insurance policy.

And this assumes taxes never go up.

Now that you know the truth; how do you feel about paying 3 to 5 times more taxes than you would with a tax-advantaged plan?