By Brett Kitchen and Ethan Kap

One of the main concepts that is important for creating a successful retirement is INCOME CALIBRATION.

That means creating an income that is designed to give you MORE income when you need it later in life.

I talked to 3 different people today on consultations and every one of them said that inflation during retirement was a concern…

This is the fallacy of FIXED income.

Why would you want to fix your income for 20 or 30 years, while inflation is running at 3, 4, 5, or 8 percent PER YEAR?

That’s just foolish thinking.

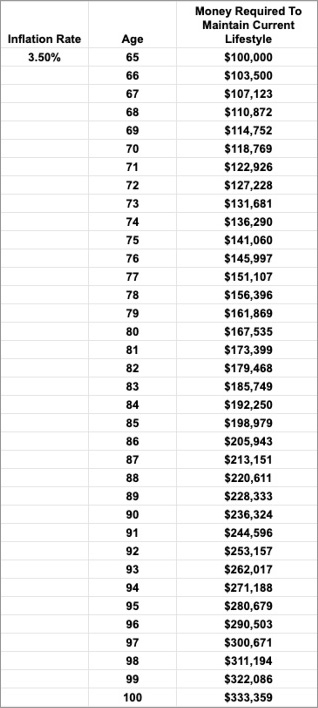

Take a look at JUST a 3.5% inflation rate does to a $100,000 per year income.

In 10 years, age 75, it’s cut your lifestyle down by 40%, and by age 80, your money is cut by almost 70%, by age 85 your buying power is cut in half.

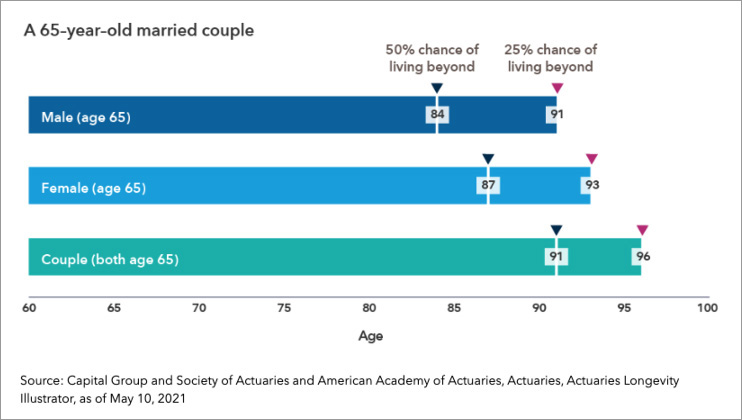

Mortality data shows that a couple at retirement age of 65 has a 50% chance of one of them living to age 91, and a 25% that one of them lives past age 96.

This means it’s wise to plan on one of the two of you living to 90 because there is a 50-50 chance that WILL happen.

What does that mean for your money?

If you started living off a 100k at age 65, by age 90 you’ll need $236,000!

And guess what, Social Security ain’t going to do it for you. Even if Social Security is still around, the Cost of Living increase will likely lag the true inflation rate because the gob’ment, needs to keep their costs down.

For example, in 2022 the Cost of Living Adjustment was 5.9%, did your food, energy, and transportation costs only go up 5.9%? I doubt it. Gas alone went up almost double!

This is the ESSENCE of what Income Calibration does, within our Scientifically Optimized Retirement Process.

Your retirement income must be calibrated to INCREASE with inflation so you don’t end up with your standard of living being crushed.

Wall Street loves to talk about ‘fixed income’ like it’s some sort of ‘good deal’ for conservative investors and retirees’.

I can’t help but be blunt about this. Fixed income is a stupid strategy and using annuities to lock in a fixed income is not the solution.

So here’s the million dollar question:

Do you have a plan to double your income in 15 years during retirement?

If not, then maybe it’s time to consider calibrating your income.

One of the strategies we use for Income Calibration right now produces income that goes up throughout retirement.

It’s the only product in the world like it. And it’s FLYING off the SHELVES because it does exactly what retirees want…create guaranteed income that increases throughout retirement.