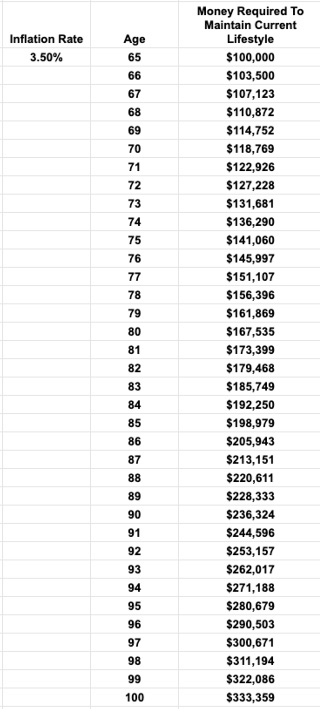

One of the main concepts that is important for creating a successful retirement is INCOME CALIBRATION. That means creating an income that is designed to give you MORE income when you need it later in life. I talked to 3 different people today on consultations and every one of them said that inflation during retirement […]

Don’t Just Fit Into Someone Else’s World. Work To Make Your Own: Start A Business

Is the Venezuelan Horror Show Coming To America?

My sister in law is from Venezuela. She’s a lovely person, puts up with my brother and keeps her 5 kids in line, for the most part. She still has family there. Unfortunately, they are suffering terribly. Resources are extremely hard to come by. Last year for Christmas, instead of giving gifts to each other, […]

Why you shouldn’t max out your 401(k)

Would you focus on paying off debt or investing first? Does that matter if you’re giving up on not getting a 401(k) match? Never put off saving until you get out of debt. Human nature and habits show that once you are out of debt (or close to it), people often feel comfortable about their […]

Financial markets in presidential election years

Is this a factor investors should take seriously, or is it just entertaining to argue about? The presidential election is typically not enough to make major investing decisions in itself, however, based on how highly inflated the market is right now, it makes sense to be precautionary. Is this unusual election year likely to make […]

77 percent of Americans over the age of 40 do not know how much of their retirement savings they can safely spend each year without running the risk of outliving their assets. Many also just guess their retirement age when planning. What can people do to avoid these critical mistakes?

The best thing people can do in order to know how much they can take without running out of money is doing an income gap analysis. Financial planners, and advisors rarely actually do this kind of analysis. I’ve spoken with hundreds of people who simply say, they’ve never had help doing it. In order to […]

How ordinary investors — NOT wealthy ones — can find a suitable investment advisor.

How do you decide whether to get a financial advisor rather than just go it alone? For most people hiring a financial advisor is totally unnecessary. Why? Because financial advisors usually underperform the market index and cost you more. In fact 86% of money managers underperform their benchmarks. 86%! Warren buffet. John bogle and Charles […]

There are 3 critical moves everyone needs to make to prepare for the next recession.

1. Get your house in order. Create a war chest of cash that will allow you to pay for expenses if you lose your job. A war chest is cash In the bank that isn’t going to disappear when the stock market crashes 2. Stockpile right now. Make as much money as you can right […]

Is HyperInflation Next?

Living Your Bucket List

I’ve always loved the water, the sun and sand, and warm weather. Whether it’s at a lake or the beach. Combine the water with my love for athletics and I’m game for just about anything you can do on the water. I always thought surfing would be fun. But after trying it several times, I […]